The Health Club industry in the UK is forever evolving.

I’m sure as an adept, consummate, experienced Health and Fitness professional you will be aware of all the changes that have taken place in the last decade, but if you’re new to the industry, or you’ve been residing beneath one of nature’s solid minerals since the wake of 2008, let’s just revisit some of the major changes within the landscape we know and love.

Mid-market make way for the low-cost operator

From 2008-2014, initially as a result of the credit crunch, we witnessed the sorrow demise of the mid-market operators. This proved to be a pivotal turning point within the industry, leaving many independent gyms in a position of danger – Fitness First and LA Fitness, who at the time were the two major players within this sector, became the largest fallen victims.

The collapse of the mid-market operator coincided with the emergence of the ‘low-cost sector’. Essentially, the 24-hour budget gyms put pressure on the more traditional facilities, which lead to a polarisation within the market. With less money to spend, people simply expected more value for their money and switched from paying in excess of £40 per month to less than £20.

Today, Pure Gym and The Gym Group primarily battle it out as ‘budget gym market-leaders’. At the time of writing this post, PureGym has 250+ gyms compared to The Gym Group with 169 gyms, so it’s fair to say PureGym hold the sector’s bragging rights.

Gyms show they are here to take over

With the low-cost sector rising and the mid-market sector diminishing, buyouts, take-overs and ‘brand-mergers’ began to occur. This mainly started in May 2015, when Pure Gym acquired 43 LA Fitness sites, a move which now appears to have been profitable for the low-cost leader. More recently, in 2018, PureGym boosted their presence in the capital by snapping up 10 of London Soho Gyms sites before converting them to the usual PureGym format.

In late 2016, the mid-market attempted to fight back with operator DW Sports acquiring 62 sites from fellow mid-market operator Fitness First, this acquisition saw the brands amalgamate to become ‘DW Fitness First’. Has it been a success? Well, although in their first year of trading an £8.9 million loss was reported, DW’s membership figures did actually rise by 3%. Today it still remains to be seen whether or not this acquisition will pay dividends.

The Gym Group, who are aiming to reach 200 sites by 2020, acquired 18 Lifestyle Fitness sites in September 2017, and some 9 months later, they acquired 13 sites from another budget rival EasyGym. These investments lead to a 35% boost in revenue in 2018, so again, both moves look to have been positive ones.

It’s perhaps remarkable that in amidst of all this, the premium operators who charge the highest prices (Nuffield Health, Virgin Active and David Lloyd Leisure) still survive and thrive today. It ought to be mentioned that in 2016, Nuffield Health acquired 35 Virgin Active Clubs and a year later fellow rivals David Lloyd Leisure purchased 16 more of them. Virgin Active stated their reasons for downsizing was to fine-tune their status as a premium health club by investing more in their higher-end sites. David Lloyd and Nuffield Health remain committed to widening their footprint in the UK health club market.

New concepts enter the market

Alongside all the takeover activity, we’ve also seen the ‘JD Sports’ brand enter and disrupt the market with ‘JD gyms’. As they showcase enormous free weights zones, a ‘JD Burn’ area, luxury changing rooms and their ‘seriously stylish’ (their words although I must say it’s hard to argue) gym floor, they have certainly put their own spin on what a budget-gym should look like.

And speaking of ‘seriously stylish’, boutique gyms brands such as Core Collective, 1 Rebel, Barry’s Bootcamp, F45 and Orange Theory Fitness have exploded onto the scene, especially in the South of England; there are now more than 300 boutique fitness studios in London. Is this a fad or something that is here to stay? A recent message from the Sweat 2019 Conference was that this boom is nowhere near ‘breaking point’.

Alongside the low-cost model and the boutique model, we’ve started to see some ‘hybrid’ models emerging. Operators such as The Fitness Space and Snap Fitness have combined quality instructor-led classes with a small gym floor space focused on specialist coaching and wearable technology.

Specialist training providers have also chiselled away at the traditional operator. Within the last 10 years, CrossFit has gone from a small-scale, alternative gym workout, to an explosive, community-focused worldwide phenomenon; the UK now has over 500 CrossFit affiliates. Parkrun and Be More Fit (BMF) have further contributed to taking members from gyms to outdoors. Yoga and Barre studios continue to be a growing trend in the UK while Boxing, Brazilian Jujitsu and MMA facilities are also holding their own in attracting their niche audiences.

With so many Health Club operators and models to choose from, Hussle (formerly PayAsYouGym) decided to capitalise on the growing trend in gym usage by putting the consumer at the heart of the decision-making progress. Hussle allows the consumer access to a multitude of gyms which sit on the Hussle platform. This means the end-user does not have to pledge their allegiance to any particular gym over a long period of time. Instead, they can use their gym of choice via a more flexible, pay as you go app.

The developments within the fitness industry have not just been confined to the four walls. Online Personal Training and ‘at home’ concepts have also shaken up the industry as we know it. Ultimate Performance Fitness and The James Smith Academy are two examples of what appear to be successful ‘online’ PT models while GymCube, Peloton and FiiT have flexed their muscles in the ‘at home’ space.

Where do we stand in 2019?

To summarize where we are today, the health and fitness industry today is the healthiest it has ever been. With more gyms, more members and higher market value than ever before, according to the 2019 State of the UK Fitness Industry Report, the penetration rate now stands at 15.6% with 1 in every 7 people being acknowledged as a gym member.

The UK is undoubtedly enjoying a golden period of growth, and as you can glean from this post so far, traditional operators must not just compete against each other, but against at-home fitness, boutique gyms, specialist providers and aggregators to sustain their place in the market.

With so many new trends emerging, all Health Club operators must have an appetite for innovation. The idea of ‘business as usual’ will simply not comply with the ever-changing conditions of the fitness industry, yet decision-makers must still remain cautious as one bad move could spell disaster.

If you’re reading this post as a Health Club operator, there are several options for you to grow and innovate. You can develop a new product or service or you can open up to new markets, but how do you know which one will be the most fruitful for your Health Club?

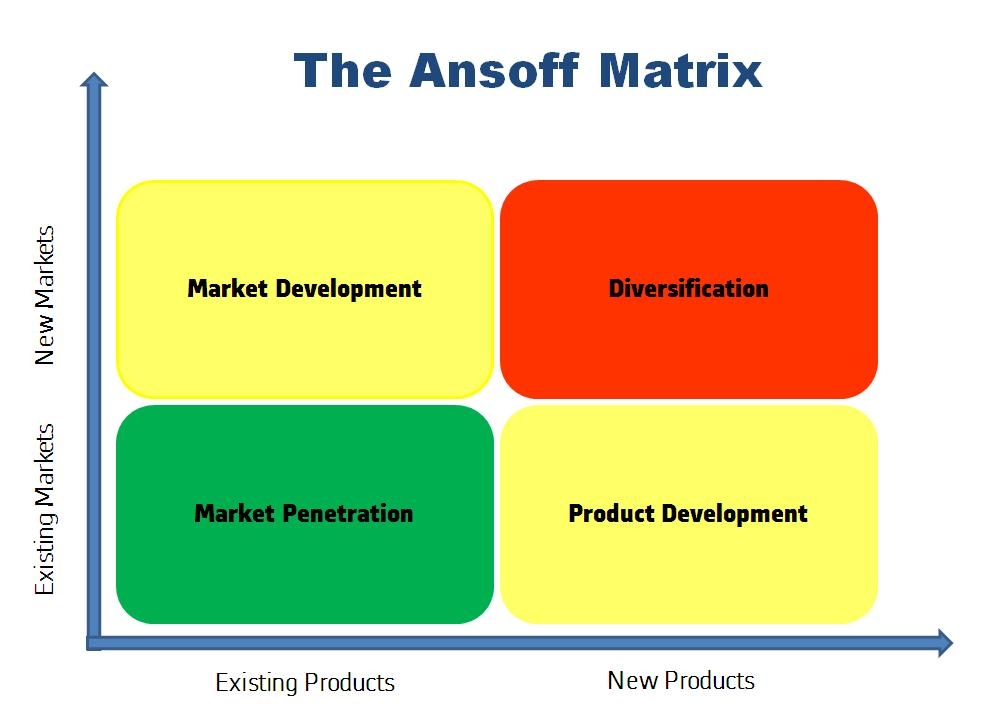

Today I want you to introduce you to the ‘Ansoff Matrix’, a tool which will give you some potential options and help you devise the most suitable plan for your Health Club.

What is the Ansoff Matrix?

The Ansoff Matrix was founded by H. Igor Ansoff and was published in the Harvard Business Review in 1957, in an article titled “Strategies for Diversification.”

The tool has provided generations of marketers and business leaders with quick and straightforward ways to consider the risks associated with growth.

The Matrix reveals four strategies you can use to grow, which can be seen in each quadrant. The main principle of the Matrix is that each time a business enters into a new quadrant (either horizontally or vertically), the risk will increase.

I’ll examine each quadrant in more detail, with some application to the world of Health and Fitness.

Market Penetration

Market penetration, in the lower-left quadrant, is considered as the safest of the four options. Here, the focus is simply on business expanding sales of existing products/services in their existing markets.

For gyms, simply broadening opening times and class times may facilitate market penetration. Such changes in availability may encourage those who weren’t able to attend previously due to work commitments to become members.

An increase in sales activity, a cleverly executed marketing campaign, or the introduction of a special offer are the most common ways for Health Clubs to achieve market penetration. We see many examples of gyms doing this, especially in January and around key events within the year. Check out how to execute a successful marketing campaign here.

The acquisition of new sites, as Pure Gym, The Gym Group, Nuffield Health and David Lloyd have demonstrated, will ultimately allow a Health Club to achieve market penetration.

Product Development

Product development, in the lower right quadrant, carries a slightly higher level of risk because it involves the launch of a brand new product to the already existing market.

For Health Clubs, this could be the launch of a new nutrition service or the redesigning of a Personal Training package.

Below is an example of Product Development within the fitness industry;

Premium operator David Lloyd Leisure decided to fight back against the boutique gyms by offering their own studio based concept ‘Blaze’. Similarly to the Boutique gyms, Blaze combines high-intensity cardiovascular training with strength and combat exercises in a fast-paced workout and all activity is monitored and classified through wearable technology.

Why is this Product Development? Blaze may well be aimed at David Lloyd’s existing target market of those aged 24-50 within the ABC1 demographic but the service they are providing is certainly fresh and unique.

Think about ways your Health Club can expand and evolve its offering while keeping the target audience the same – should you go ahead, that’s Product Development.

Before you go gung ho, all guns blazing with new product launches, just bear in mind that although Product Development is considered ‘low risk’ in Ansoff’s model, in a Health Club setting that may not always be the case. Launching a brand new concept (Product Development) often requires the acquisition of some brand-new equipment, the recruitment of fresh instructors and a considerable amount of marketing and promotion to generate a buzz, so depending on what you have planned, you need to weigh up the risk accordingly.

Market Development

Market development, in the upper left quadrant, is viewed as the third riskiest option as it involves placing an already existing product into an entirely new market. In many eyes, building a brand to a new following is considered tougher than launching a new product to the same audience.

A hypothetical example of Market Development within the Health Club industry would be a Low-Cost Budget Operator deciding to target newly engaged couples in the run-up to their wedding. The marketing message would be centred around budding brides and grooms looking their best on their big day, the product they would be marketing may be a couples membership package.

While the membership package may be marketed differently, it is essentially the same as a regular membership package, there would be no additional features of benefits within the actual membership. The difference is the customer segment – newly engaged couples.

Another example of Market Development, would be a health club deciding to expand overseas. With a new country, comes a whole new market.

International expansion certainly carries must larger risk than reaching out to new customer segments, so again, with Market Development, it’s important to weigh up the risk of each specific move you’re wanting to make before implementing decisive action.

Diversification

Diversification, in the upper right quadrant, is the riskiest of the four options, as it incorporates the introduction of a brand new, unproven product into an entirely new market.

We see from the earlier example, David Lloyd Leisure used their Blaze concept to show their resistance towards the Boutique sector. Well, low-cost gym chain Xercise4Less also attempted a fightback.

In 2018, Xercise4Less went from offering budget gym memberships starting at £9.99pm to selling exclusive 8 Week Transformation Camps at £100. The 8 Week Transformation Camps were designed to take place in bespoke training zones consisting of curved treadmills, TRX straps, slam balls, step-boxes, concept rowers, battle ropes and kettlebells. During the camp, members are encouraged to log their exercises and track their nutrition via an app, the camps also include weekly weigh-ins to monitor clients progress.

To an extent, I consider the above example ‘Related Diversification’. Through offering a completely different service with a larger price point, Xercise4Less opened themselves up to prospects with greater disposable income, ones who may have otherwise joined a premium health club or a boutique gym. This community-based type of training, in which the focus is largely on weight loss and nutrition also means Xercise4Less may attract a different kind of member, one who may have an advocate of Slimming World or Weight Watchers previously. In short, it’s a new product aimed at a slightly different market, and time will tell whether this proves to be a stroke of genius from the low-cost provider.

A more extreme example of ‘Unrelated Diversification’ was when Virgin Group, who at the time were known as a record company (Virgin Records) and an airline company (Virgin Atlantic), decided to enter the fitness market with Virgin Active. In this case, there is no real synergy between either products and markets which is why it is termed ‘Unrelated Diversification’. In a sense, this would be akin to UBER, who specialise in taxis and food delivery, deciding to revamp their services by delivering home Personal Training.

As you can see with diversification, the risks are much higher as a business wanders into uncharted territory. When a business launches a new product to a new market, they can no longer use their own expertise, backed up by data and insight, to predict future success.

Closing comments on the Ansoff Matrix

The purpose of this post was to make you consciously aware of the Ansoff Matrix quadrants. In haste, it’s easy to say ‘let’s do this’, without realising that launching new products, or entering new markets, carries a great deal of risk.

By simply opening your eyes up to this model, it should allow you to make more thoughtful decisions surrounding the development of your Health Club. Innovation is great, but it doesn’t have to be serendipitous or rushed, it can be intentional and it can be performed in a strategic manner.

So when going through the Ansoff Matrix, weigh up the dangers and pitfalls associated with each quadrant, examine the possible threats that you may face and financially estimate how your profits may look if such threats materialize. Only once a thorough risk analysis has been conducted can you start to identify growth opportunities and at that point, you will then be in a position to make accelerated, innovative business decisions which drive sustainable competitive advantage.